529 Plan Limits 2025

Blog529 Plan Limits 2025. You can absolutely use a 529. Each state’s 529 plan vendor sets its own aggregate contribution limit.

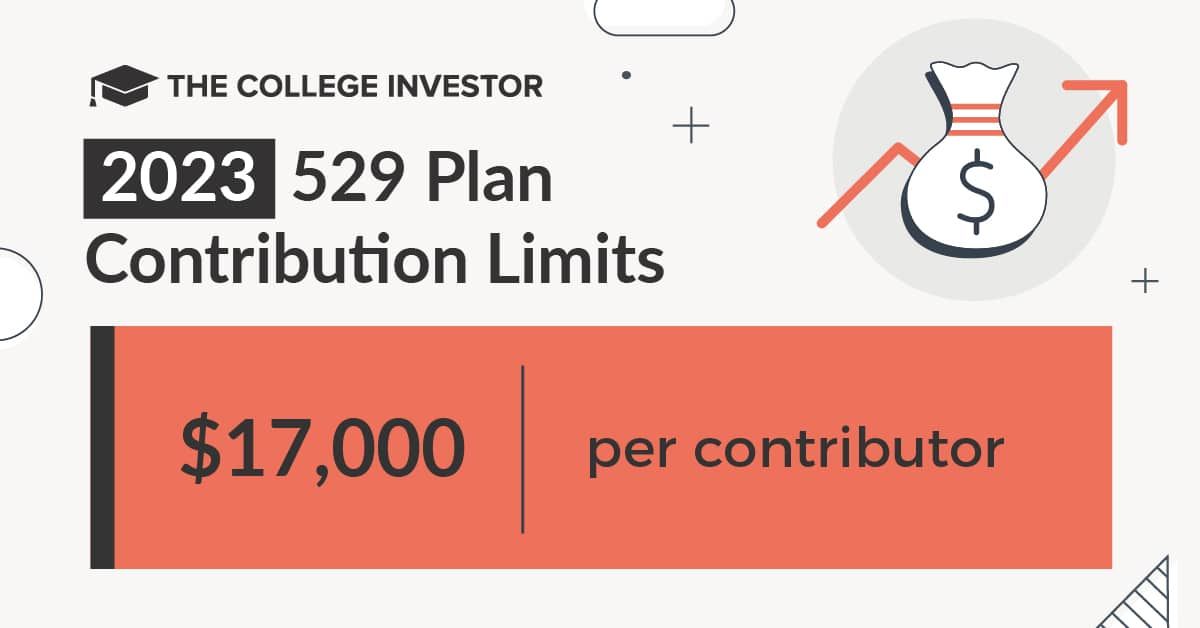

529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. Find each state’s lifetime contribution limit per beneficiary.

529 Contribution Limits 2025 Wisconsin 2025 Loria Arielle, Research state tax exemptions, fees,.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

How Much Can You Contribute To 529 Plan In 2025 Elli Noella, The 529 plan must be open for at least 15 years before it can be rolled over into a roth ira and there’s a $35,000 lifetime limit on rollovers.

Iowa 529 Plan Contribution Limits 2025 Calculator Holli Celestia, 529 plan aggregate contribution limits by state.

529 Plan Limits 2025 Texas Shane Darlleen, In 2025, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709.

Iowa 529 Plan Contribution Limits 2025 Over 55 Harley Marlena, 529 plan aggregate contribution limits by state.

Wisconsin 529 Deduction Limit 2025 Carlyn Stephi, Unlike retirement accounts, the irs does not impose annual.

Maximum 529 Plan Contribution 2025 Jade Rianon, Since each donor can contribute up to $18,000 per beneficiary, a married couple can.